The working relationship between the Board of Supervisors and the Board of Directors is based on the following basic principles:

The board manual is a guideline for the Board of Supervisors and the Board of Directors which aims to:

By using the Board Manual in the working relationship between the Board of Supervisors and the Board of Directors, all Social Security Agency for Employment activities can be carried out in harmony with reference to the good governance principles.

Social Security Agency for Employment has a Regulation of Board of Supervisors and Regulation of Board of Directors concerning Main Duties, Functions and Authorities which are derivatives of the Law Number: 24 of 2011 on the Social Security Agency.

The Board Manual emphasizes on:

The Social Security Agency for Employment Code of Ethics is a set of unwritten norms or values that are believed by employees as a standard of behaviour based on laws and regulations and work ethics. The Social Security Agency for Employment Code of Ethics must be complied with by all Directors and Employees of Social Security Agency for Employment.

Functions of the Social Security Agency for Employment Code of Ethics

Institutional Code of Ethics

It contains the following:

Social Security Agency for Employment personnel shall have faith and devotion to the Almighty God, working as a worship to provide benefits and values for the emploeyees themselves, their families, the communities and nations.

Social Security Agency for Employment personnel shall always be professional, innovative, and serious in seeking the best results to provide benefits and added value for the organization and the environment.

Social Security Agency for Employment personnel shall always start from themselves to behave in accordance with applicable norms, ethics and regulations so that they can become role models for the surrounding environment.

Social Security Agency for Employment personnel shall be able to build cooperation, harmony and prioritize mutual success.

Social Security Agency for Employment personnel shall always be reliable, honest, consistent, trustworthy, and committed to complying with applicable norms and regulations.

Social Security Agency for Employment personnel shall always care about participants, the work environment, and the organization so that they feel responsible and sincerely participate actively to bring the progress of the organization.

Social Security Agency for Employment personnel shall always work joyfully, proactively, and enthusiastically in carrying out their duties.

Social Security Agency for Employment realizes that in every activity of the Agency there is always an inherent risk, both from internal and external factors. Social Security Agency for Employment implements Integrated Risk Management, which is a process that is influenced by all personnel of the Agency, which is applied in determining strategies for the entire aspects of the Agency and is designed to identify potential events that may affect the Agency. It also manages risks in accordance with the Agency's risk appetite, in order to provide efforts of ensuring the achievement of the Agency's objectives. Risk management is carried out actively and continuously with reference to ISO 31000:2018 Risk Management-Guidelines.

The Board of Directors of Social Security Agency for Employment stipulates the Risk Management Philosophy underlying the implementation of risk management within the Agency, as follows: “To contribute to the realization of Good Governance and trust in serving and managing participant funds with careful risk management in accordance with the laws and regulations”.

In order to realize risk management practices based on the risk management philosophy above, the Board of Directors is committed to always complying with the provisions of laws and regulations, managing existing conflicts of interest, allocating adequate resources for the implementation of the risk management process, as well as developing internal capabilities in maintaining and improve the effectiveness of risk management practices on an ongoing basis.

The implementation of risk management is grouped into 3 (three) elements, which consist of the principles of Risk Management, Risk Management Framework, and Risk Management Process.

The purpose of risk management is to create and protect values, which is realized by improving performance, encouraging innovation and supporting the achievement of goals.

The eight Risk Management Principles that form the basis for implementing the risk management framework and process are:

The Risk Management Framework consists of:

The Risk Management Process consists of:

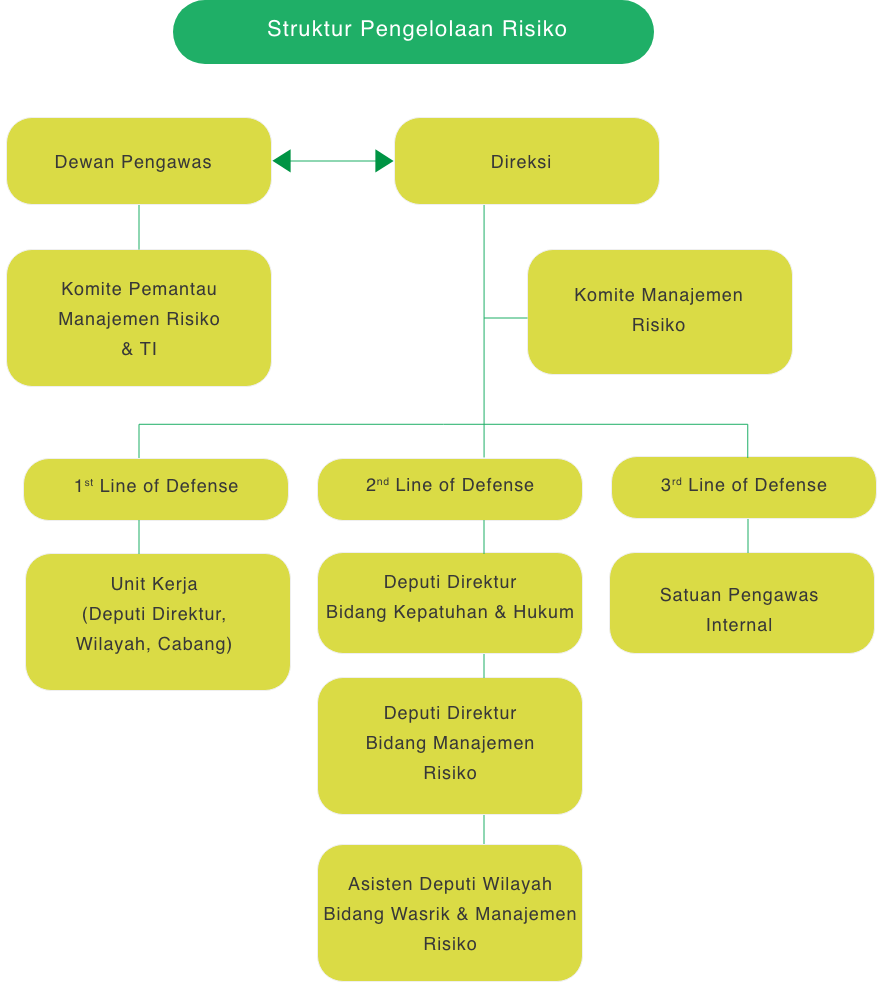

The Board of Supervisors is in charge of supervising the implementation of management of Social Security Agency for Employment by the Board of Directors and providing direction and or advice to the Board of Directors which includes aspects of risk management.

The Board of Directors acts as the main accountability stakeholder in ensuring that the implementation of risk management at the Agency level runs effectively. The Board of Directors ensures the implementation of the Good Corporate Governance principles in every aspect of the Agency's activities, as well as the implementation of effective, proactive and sustainable risk management, along with sustainable development adjusted to the needs of the Agency.

The Risk Management and IT Monitoring Committee acts as a committee formed by the Board of Supervisors to support the monitoring function of the implementation of risk management and information technology at Social Security Agency for Employment. The Risk Management and IT Monitoring Committee has a role and authority that refers to the regulations stipulated by the Board of Supervisors.

As needed, the President Director may establish a Risk Management Committee which aims to provide facilitation and consultation for the Board of Directors, particularly the President Director in making strategic decisions of the Agency with significant risk exposure.

The Risk Management Committee is chaired by the Director in charge of the Risk Management function, with the majority members of the Directors, and the Deputy Director for Risk Management as the secretary and related executive officers. The Director who holds the position as Chairman and member is a permanent member of the committee who has voting rights in decision making. Meanwhile, the Secretary and related executive officers are non-permanent members of the Risk Management Committee who do not have voting rights in making decisions, but they are required to provide views before decisions are made.

The Deputy Director for Risk Management has a role in coordinating the overall implementation of Social Security Agency for Employment risk management.

The Deputy Director for Compliance and Legal Affairs has a role to carry out the supervisory function of compliance and law.

The Internal Supervisory Unit has a role in assisting the Board of Directors in carrying out independent supervisory functions for the continuity of the effectiveness of internal control in the operational activities of the Agency, particularly in risk management practices.

It has the role of coordinating and facilitating the implementation of risk management in Regional Offices, Branch Offices and Pioneer Branch Offices.

The Risk Owner Work Unit has a role in ensuring the implementation of strategies and work programs as well as inherent supervisory activities in order to achieve the goals or objectives of the Agency as a form of control over the risk of operational activities.

Risk Agents can be appointed through a Board of Directors Order with duties and responsibilities, including increasing awareness of risk management implementation, evaluating the effectiveness of internal control, and providing consultation and facilitation on the implementation of risk management in work units.

To prevent fraud in the implementation of the employment social security program in the National Social Security System (SJSN) as well as in the context of implementing good governance principles, the Board of Directors of Social Security Agency for Employment has established a Fraud Control System.

Fraud Control System is a control system specifically designed to avoid & prevent, detect, and take action against incidents that are indicated as fraud. The Social Security Agency for Employment itself defines fraud as an act that is dishonest in obtaining profits or causing Social Security Agency for Employment to suffer losses by deceiving or in other ways.

Management is committed to zero fraud tolerance within the Social Security Agency for Employment and will take action or impose sanctions in accordance with the provisions of the legislation and/or the provisions of Social Security Agency for Employment.

The implementation of the Fraud Control System is carried out by developing a control system that is specifically designed in an effort to prevent, detect, and take action against incidents indicated as fraud, marked by the presence of 10 Fraud Control System attributes:

Attribute 1, Integrated Anti-Fraud Policy;

This is fulfilled by the availability of a Board of Directors Regulation regarding Fraud Control

Attribute 2, Structure of Accountability for Fraud Control;

This is fulfilled by the establishment of the Fraud Control Unit, chaired by the Deputy Director for Compliance and Legal Affairs.

Attribute 3, Fraud Risk Assessment, in this case referred to as Fraud Risk Assessment;

Fraud Risk Assessment has been carried out in collaboration with BPKP in 2015, 2016/2017, 2017/2018, with the following results:

2015: The risk of fraud at Social Security Agency for Employment is at the Medium Fraud Risk level, because the Evaluation Program is categorized as Sufficiently Adequate;

2016/2017: the risk of fraud in BPJS TK is at the Medium Fraud Risk level, because the Evaluation Program is categorized as Sufficiently Adequate

2017/2018: the Social Security Agency for Employment already has an anti-fraud policy and has made efforts to implement the policy in the organization's operational activities, however there are still areas of improvement

Attribute 4, Concern of Employees for Fraud Incidents;

Continuous socialization is carried out to all employees, from Education and Training for Job Preparation to Advanced Level Training for employees who will hold Level 1 positions.

Attribute 5, The Concern of Social Security Agency for Employment Participants and the Public for Fraud Incidents;

Participants and the public can report fraud incidents that occur within Social Security Agency for Employment through the Whistleblowing System (WBS).

Attribute 6, Fraud Incident Reporting System;

The application for reporting indications of fraud can be accessed at https://wbs.bpjsketenagakerjaan.go.id/

Attribute 7, Protection to Whistleblowers;

Management protects all participation efforts from employees, participants, and the public who report fraud incidents committed by the Internal Supervisory Unit, Deputy Director for Legal Compliance, and in collaboration with LPSK.

Attribute 8, Investigation Procedures;

It is complied with standard procedure guidelines for investigation of fraud by the Internal Supervisory Unit and inspection procedures by the Deputy Director for Human Capital.

Attribute 9, Action and Disclosure to External Parties;

Reporting to external parties is carried out in accordance with the Decision of the Board of Directors of Social Security Agency for Employment based on the Report on Audit Results conducted by the Internal Supervisory Unit.

Attribute 10, Standards of Conduct and Employee Discipline

This is fulfilled by the issuance of Regulation of the Board of Directors of Social Security Agency for Employment regarding the Code of Ethics and Personnel Management.

To manage fraud control activities at Social Security Agency for Employment, a Fraud Control Unit is formed. The Fraud Control Unit is chaired by the Deputy Director for Compliance and Legal Affairs, consisting of a Work Unit that is responsible for the implementation of Fraud Control System attribute and other related work units. Social Security Agency for Employment has also been supported by a number of employees who have been certified by the Professional Certification Institute as Anti-Corruption Counsellors.

Gratuity Control

To support the realization of a corruption-free Indonesia and for the implementation of a transparent and accountable management of the national social security system, Social Security Agency for Employment is committed to controlling gratification within the Social Security Agency for Employment.

As a form of commitment in controlling gratification within Social Security Agency for Employment, the President Director and the Chairman of the Board of Supervisors together with the KPK Leaders have signed an anti-corruption commitment on September 16, 2016. This Joint Commitment to Integrated Corruption Prevention includes several things, including the Social Security Agency for Employment Commitment which is supported by the KPK to develop a National Integrity System with an approach to work culture and the spirit of prospering the country and the implementation of gratification control in preventing and eradicating corruption within Social Security Agency for Employment.

Employment BPJS entire personnel are required to report all forms of gratuities and rejection of those who have a conflict of interest. To make it easier to report gratification, the management has provided a means of reporting through an application that can be accessed online by all Social Security Agency for Employment personnel.

This application is not only used to report gratification, but also fraud and conflicts of interest.

In order to improve prevention of corruption through gratification within Social Security Agency for Employment, a Gratuity Control Unit (UPG) was formed which functions to carry out socialization, analysis, reporting, monitoring and evaluation of the implementation of gratuity control Social Security Agency for Employment to KPK.

Gratuity reports made by Social Security Agency for Employment personnel through SiPatuH are forwarded by UPG to KPK through KPK's Online Gratuity (GOL) application.

To ensure the implementation of gratuity control in all work units, Social Security Agency for Employment has also established Tunas Integritas with a total of more than 468 personnel spread across all Social Security Agency for Employment Work Units. One of the tasks of Tunas Integritas is to provide socialization and education as well as to build an anti-corruption culture in their respective work environments.

As a form of achievement for the efforts made by Social Security Agency for Employment in controlling gratification, Social Security Agency for Employment was awarded as the institution with the best control system at the World Anti-Corruption Day (HAKI) event organized by KPK for two consecutive years, 2017 & 2018.

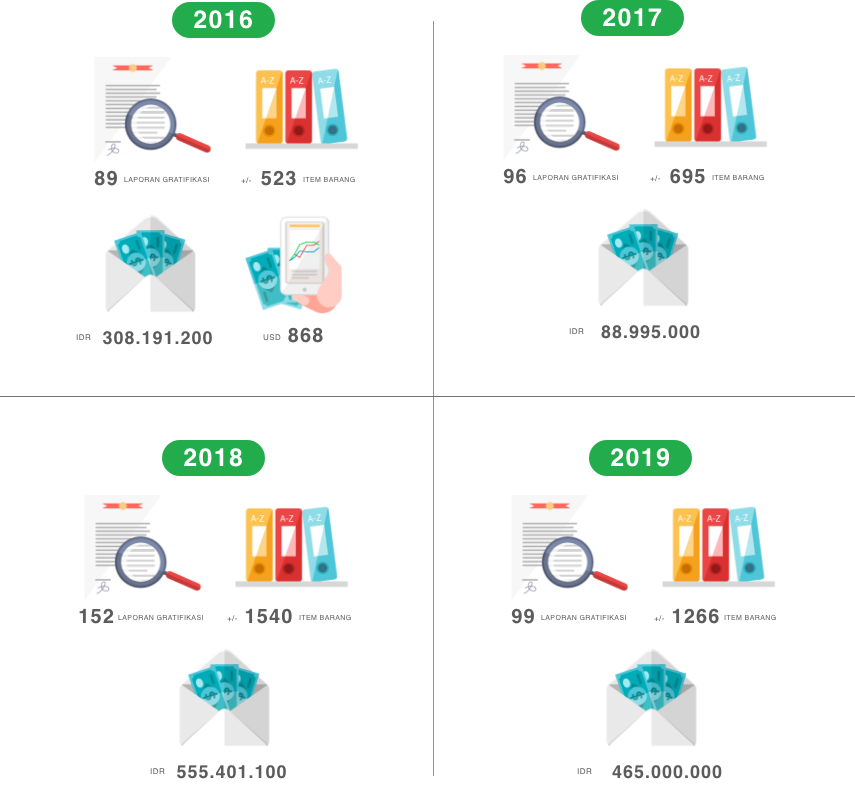

Gratuity Reporting at Social Security Agency for Employment from 2016 to July 2019

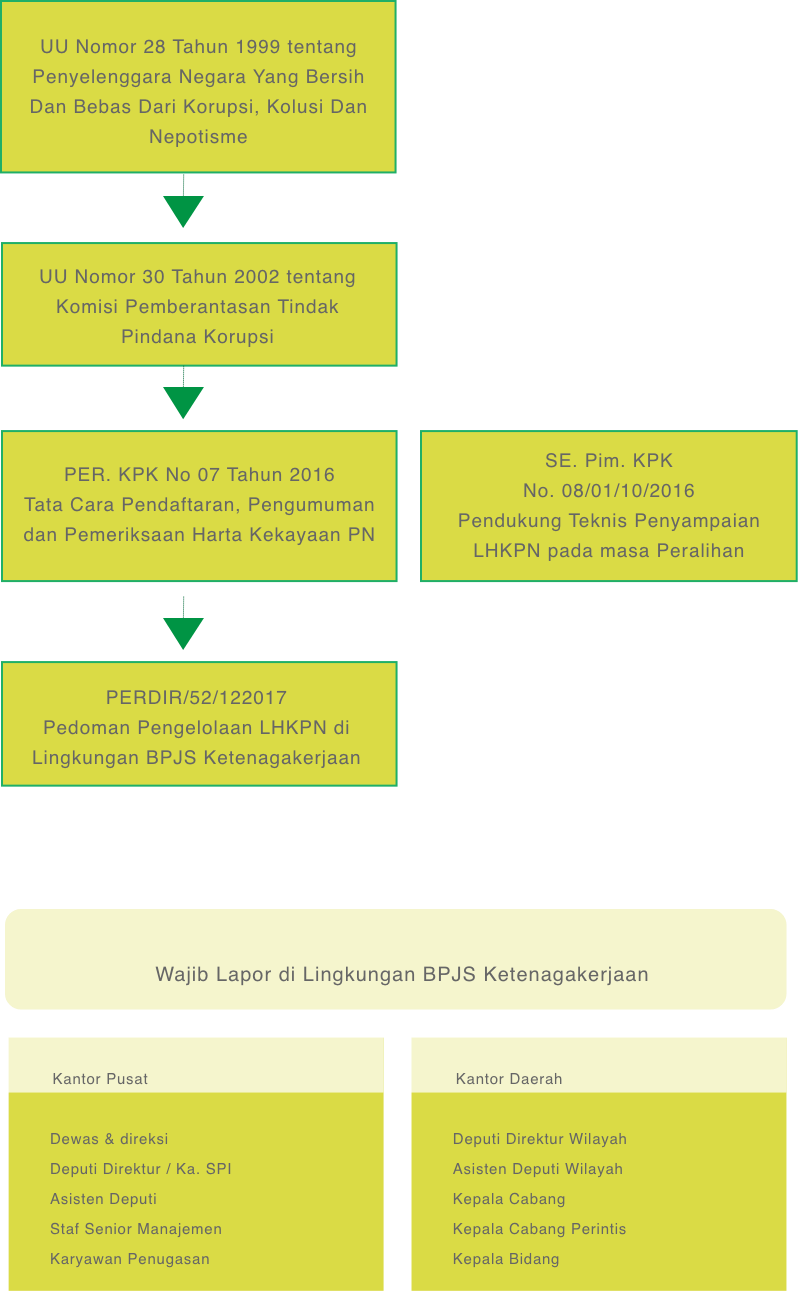

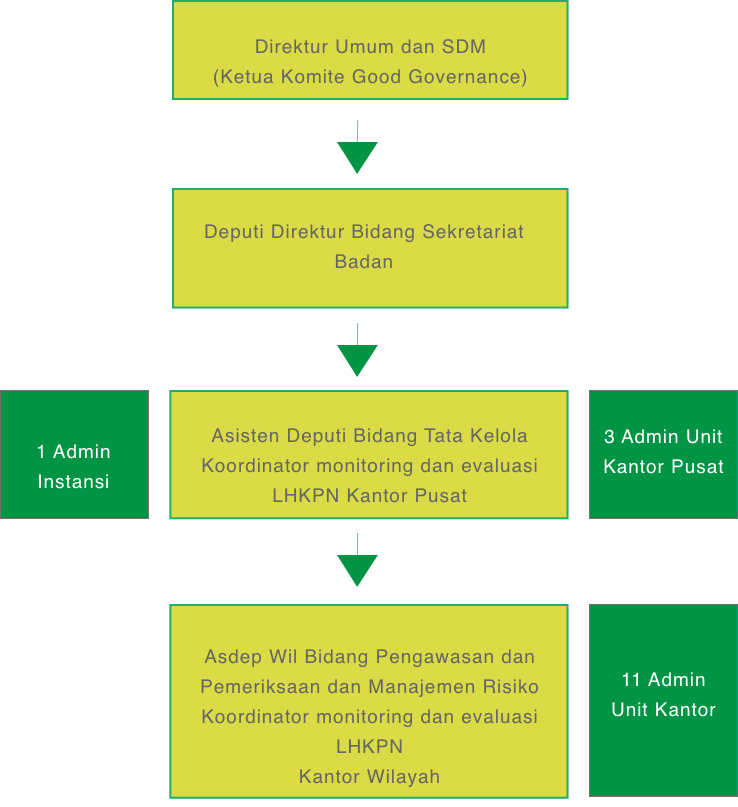

LHKPN (Report of State Officials Wealth) is a joint commitment between Social Security Agency for Employment and the Corruption Eradication Commission (KPK), where in order to support the anti-corruption, anti-fraud and anti-gratification movement, Social Security Agency for Employment strengthens the Social Security Agency for Employment Integrity System through the Whistleblowing System, Gratuity Control Unit, Fraud Control Unit, Complaints Service Unit, Conflict of Interest Reporting, LHKPN Reporting, Code of Ethics and Cultural Values to ensure there is no opportunity for corruption internally or with external parties.

With the signing of a commitment to integrated corruption prevention between the President Director, Chairman of the Board of Supervisors of Social Security Agency for Employment together with the Chairman of the Corruption Eradication Commission in 2016, KPK supports Social Security Agency for Employment in building a National Integrity System within Social Security Agency for Employment.

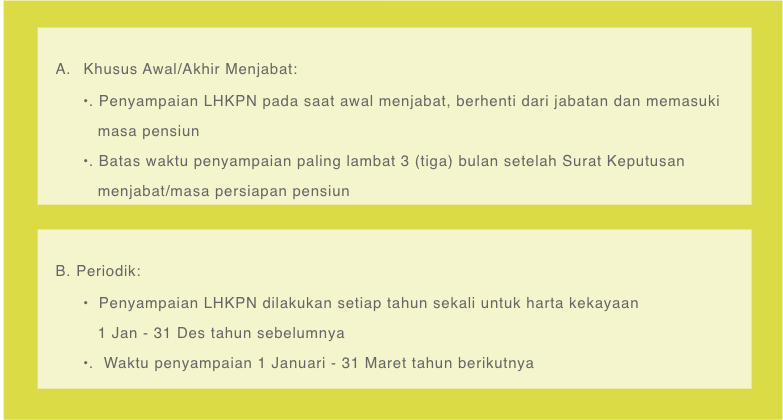

As a person who is required to submit a report, the State Administrator is obliged:

To find out the status of the LHKPN report, please click:

Concerning Social Security Agency

"The Social Security Agency has the authority to carry out supervision and inspection on the compliance of Participants and Employers in fulfilling their obligations in accordance with the provisions of laws and regulations on national social security"

Concerning Procedures for Imposing Administrative Sanctions to Employers other than State Officials and to Individuals other than Employers, Workers, and Beneficiaries of Contribution Assistance in the Administration of Social Security

"In carrying out supervision and inspection of compliance in the implementation of the social security program, BPJS appoints inspectors"

Concerning Procedures for Supervision and Inspection of Compliance in the Implementation of the Employment Social Security Program

"The supervision and inspection as referred to in paragraph (1) shall be carried out by Inspectors on Employers other than State Officials and Everyone, other than Employers and Workers."

The duties of Inspectors: to carry out supervision and inspection activities to ensure the compliance of the employer to the fulfilment of obligations on registration, submission of worker data, wage/income data and any changes thereof in accordance with the provisions of the legislation.

Criminal Violation

Type of Violation: Company in Arrears of Contribution/PMI (Article 19 paragraph (1) and paragraph (2))

Criminal Sanctions (Article 55)

Employers who violate the provisions as referred to in Article 19 paragraph (1) or paragraph (2) shall be sentenced to a maximum imprisonment of 8 (eight) years or a maximum fine of Rp. 1,000,000,000.00 (one billion rupiah).

Administrative Violation

Type of Violation: Partially Registered Company/PDS & Unregistered Company/PWBD (Article 15 paragraph (1) and paragraph (2))

Administrative Sanctions (Article 17 paragraph (1) and paragraph (2))

Sanctions in the form of written warnings and fines are imposed by Social Security Agency for Employment

1. First Warning Letter

The first written warning is imposed for a maximum period of 10 (ten) days by Social Security Agency for Employment

2. Second Warning Letter

If after receiving the first written warning the Employer does not carry out its obligations, the Social Security Agency for Employment will impose a second written warning for a period of 10 (ten) days.

3. Penalty Sanctions

A fine of 0.1% of the contribution that should be paid will be imposed if after the expiry of the imposition of the second written warning, the Employer does not carry out its obligations. (Penalty sanction of 30 days)

"The imposition of sanctions in the form of exceptions to certain public services is carried out by public service units at government agencies, provincial governments, or district/city regional governments."

4. Exceptions to Certain Public Services (TMP2T)

If sanctions in the form of fines are not paid in full, then the Employer is subject to sanctions in the form of exceptions to certain public services.

The Internal Control System is a process that is influenced by the leaders and all employees in the organization, which is designed to provide adequate confidence in the achievement of objectives which include:

Social Security Agency for Employment Internal Control System is an Internal Control System which is implemented thoroughly in the Head Office, Regional Offices and Branch Offices of Social Security Agency for Employment.

The Internal Control System consists of 5 components as follows:

In order to ensure that the internal control system is adequate and functioning properly, Social Security Agency for Employment establishes an Internal Supervisory Unit.

Internal Supervisory Unit is the internal supervisory apparatus of Social Security Agency for Employment which is directly responsible to the President Director.

Internal Supervisory Unit is a division of Social Security Agency for Employment which always has to carry out activities or tasks that can provide added value for Social Security Agency for Employment.

The role of the Internal Supervisory Unit is to support the management of Social Security Agency for Employment by carrying out operational activities in the form of:

In carrying out this role, the Internal Supervisory Unit has a Code of Ethics as a code of conduct for all employees of the Internal Supervisory Unit. The Code of Ethics for the Internal Supervisory Unit of Social Security Agency for Employment is as follows:

The authority of the Internal Supervisory Unit as an independent unit is as follows:

The Whistleblowing System (WBS) application of the Employment BJPS is an application for managing and following up on complaints and reporting the results of complaint management provided by Social Security Agency for Employment.

WBS is a means for every official/employee of Social Security Agency for Employment as an internal party and the wider community using Social Security Agency for Employment services as an external party to report suspected violations and/or dissatisfaction with the services performed/provided by officials/employees of Social Security Agency for Employment.

Some of the objectives of the WBS are as follows:

Scope of Whistleblowing System (WBS) is:

WBS within Social Security Agency for Employment is managed by the Integrity Committee which is directly responsible to the President Director.

The Integrity Committee consists of:

Complaint reports can be submitted through 2 mechanisms to the Integrity Committee, namely:

Whistleblowers can contact or submit violation reports directly to the BPJS Employment Internal Supervisory Unit.